Do you have a super special gold coin that is crazy rare, special or has been appraised at a very high value and you do not want to accept a payout at just gold weight?

Click this link to see a list of crazy expensive gold coins on Wikipedia

401Gold offers a consignment service for these types of gold coins, where we try to sell the coin on your behalf and share in the profits over spot.

Typically 401Gold takes 50% of the profit over and above the spot price for your item/s, but the final profit share percentages are agreed to at the time of consigning the coin, and the rate depends on a number of factors being:

The allure of gold has captivated humanity for centuries, embodying wealth, power, and history. In today’s fluctuating economic landscape, gold coins have surged in popularity, not just as collector’s items but as tangible investments. Selling gold coins on consignment with 401Gold presents an enticing opportunity to capitalize on this market. This approach allows sellers to leverage the expertise of seasoned professionals, ensuring their precious assets reach the right buyers at optimal prices.

Consignment sales involve entrusting your gold coins to a third party, such as 401Gold, which then takes on the responsibility of selling them on your behalf. This arrangement benefits sellers by providing access to an established customer base and marketing resources, all while retaining ownership of their items until a sale is made.

401Gold stands out in the consignment space for its transparency, reliability, and unmatched expertise in precious metals. Choosing 401Gold means partnering with a dedicated team that values your success as much as you do, ensuring your gold coins are showcased to the right audience.

Before consigning your gold coins, it’s crucial to prepare them properly. This includes documenting their condition, verifying authenticity, and understanding their market value. 401Gold can assist in this process, offering guidance to ensure your coins are presented in the best light.

Selling your gold coins on consignment with 401Gold is a straightforward process. After initial valuation and agreement on terms, 401Gold takes over the marketing and sale of your coins, keeping you informed every step of the way.

Determining the right price for your gold coins is a critical step. 401Gold’s experts use current market data, the coin's condition, and historical sales to set competitive prices that attract buyers while ensuring you receive fair value.

401Gold employs a variety of marketing strategies to promote your consigned gold coins, including online listings, social media, and private viewings for serious collectors. Their targeted approach ensures maximum visibility among potential buyers.

Once a buyer is found, 401Gold handles all aspects of the sale, from negotiating prices to finalizing transactions. Their experienced team ensures a smooth and secure process for both seller and buyer.

After the sale, 401Gold promptly processes your payment, deducting a pre-agreed consignment fee. This fee structure is transparent, with no hidden costs, ensuring sellers understand exactly what to expect.

Success in consignment sales often comes down to patience, realistic pricing, and presentation. 401Gold offers professional advice on how to optimize your sale, from professional photography to detailed descriptions.

Sellers may have concerns about consignment sales, such as control over pricing and timeframes. 401Gold addresses these concerns with clear communication and flexible terms, prioritizing your comfort and confidence throughout the process.

Understanding the legalities of consignment sales is crucial. 401Gold ensures all transactions comply with relevant laws and regulations, providing peace of mind for sellers and buyers alike.

Hearing from those who have successfully sold their gold coins through 401Gold can be incredibly reassuring. Their stories highlight the benefits and satisfaction derived from partnering with 401Gold.

While consignment sales offer numerous advantages, 401Gold also informs sellers about other avenues for selling gold coins, ensuring you make the best decision for your situation.

Selling gold coins on consignment with 401Gold offers a unique blend of expertise, security, and potential for profit. By entrusting your valuable coins to 401Gold, you can navigate the complexities of the precious metals market with confidence, aiming for the best possible outcome.

Note - If you want the quick answer/summary, scroll down to the text below that reads **** Here is the important bit to read *****

As Canadians who love investing in precious metals, we have to contend with three forces that drive the final spot price for precious metals in Canadian dollars. They are:

Each of these impact our final buying or selling rate in Canada dollars, and this article will try to add to your understanding of how the USD/CAD exchange rate effects the final spot price for gold in Canadian dollars.

Next I will show you how ChatGPT answered this question (which it actually did a very good job of doing), and then I will move onto showing you graphs that illustrates the effect more clearly with data that we could only get up to 2012 for this article. OPenAI (ChatGPT), only does not give any current financial data (yet), but this should soon change.

The USD/CAD exchange rate can impact the price of gold in Canada in a few ways:

These relationships can be complex and influenced by various global factors, so while the USD/CAD exchange rate is a factor, it's just one among many that can affect the price of gold in Canada.

Again using OpenAI, over a period of several questions the following graphs clearly demonstrate what happens to the spot price of gold when major shifts in USD or CAD occur. OpenAI does not have current data after 2012, but these charts will suffice in showing the effect.

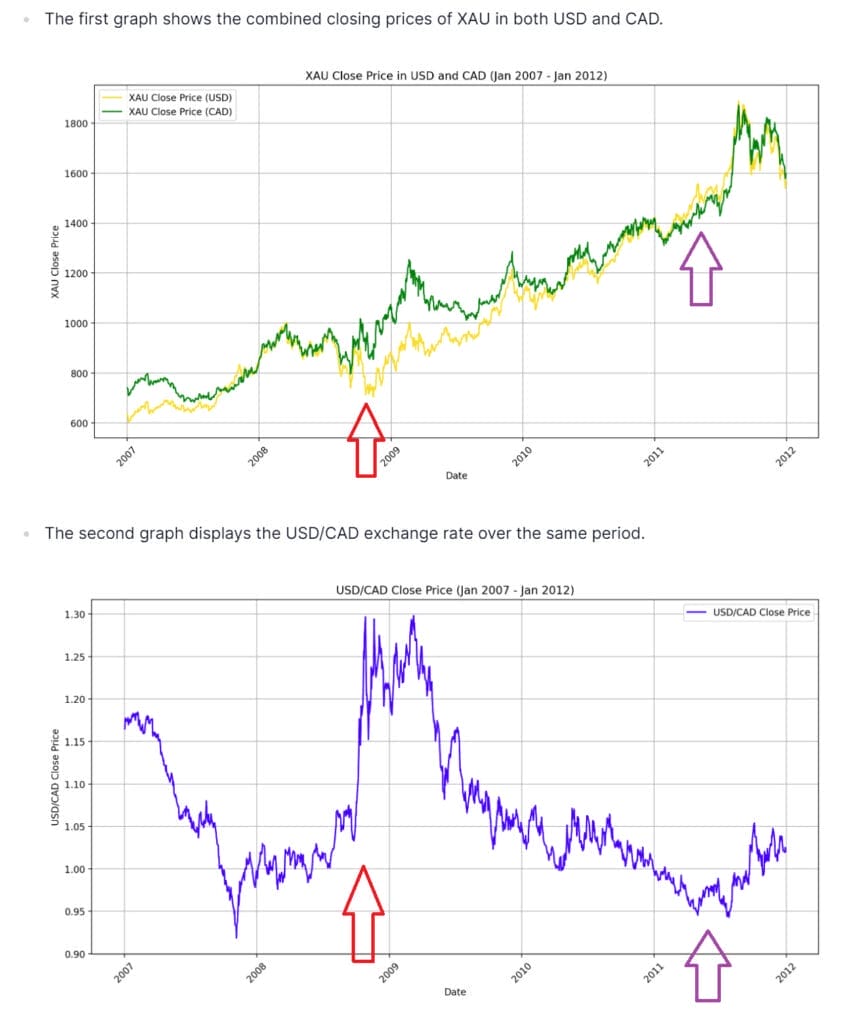

The first graph below shows the spot prices for gold from 2007 to 2012. The yellow line is the spot price of gold in USD, and the green line is the spot price of gold in Canadian dollars.

The second graph is the USD/CAD exchange rate over the same period.

**** Here is the important bit to read *****

In simple terms, when Canadian dollars are weaker against US dollars, we as Canadians get more Canadian dollars for our precious metals. The inverse is also true that when Canadian dollars are stronger against US dollars, we as Canadians get less Canadian dollars for our precious metals.

In late 2008, the Canadian dollar went from being at par with the US dollar and shot up to around $1.30 CAD to $1 USD. This can be seen in the second graph with the purple line. And when this happened, you can see that the spot price for gold in Canadian dollars also shot up (see the first graph at the same time - see red arrows), and we Canadians got more Canadian dollars for our gold.

The opposite effect also occurred in mid 2011, when the Canadian dollar had more value than US dollars (see purple arrows in the second graph), you can clearly see that the yellow line for US gold lifted higher than the Canadian gold spot price for that same period.

So you live in Toronto (or anywhere in Canada really), and you either want to know the best place to buy silver coins in Toronto and or you also want to know what the best silver coin is to buy

Obviously, we believe the best place to buy silver coins in Toronto is here at 401Gold.ca or Troy.ca and you can check out the huge number of 5 star reviews we have on Google.

We can ship anywhere in Canada, or you can come and visit us in our store conveniently located near the 401 and 404, where we have undercover parking right in front of our store and the most advanced gold testing lab in Canada for consumers to use

To us, this question is not quite right. The way we see it is that you not going to buy silver coins. What yore actually doing is a currency conversion. You're converting digital or plastic money into money made from silver. And as we all know, FIAT currencies like Canadian dollars goes down in value due to inflation, and precious metals tend to go up during inflation. Cash is worth less over time, and silver is worth more. One is Worthless, and one is worth more!

This one is super easy. The big boss of silver coins in Canada is the 1 troy ounce Silver Maple Leaf coin, and there are three key reasons for this.

Moving country - As an example, I would recommend that you buy silver coins like the American Silver Eagles if you were planning on moving to the United States, or Silver Britannia's if you were moving to Europe.

Personal Taste - Some silver coins like the Silver Britannia's have really beautiful eye appeal, and if that's what you like - then you should get them. But you should always remember that you may not get as much back for a Silver Britannia in Canada as you would get for a Silver Maple Leaf coin

Old coins and taxation in Canada - Pure silver coins are NOT taxable in Canada, but old coins that have a lower purity are now deemed taxable by the CRA. For further information about this, please visit our page on the "Risks of buying non-pure gold and silver coins".

To see a great list of what silver coins are available to day in the world, take a look at this list on Wikipedia

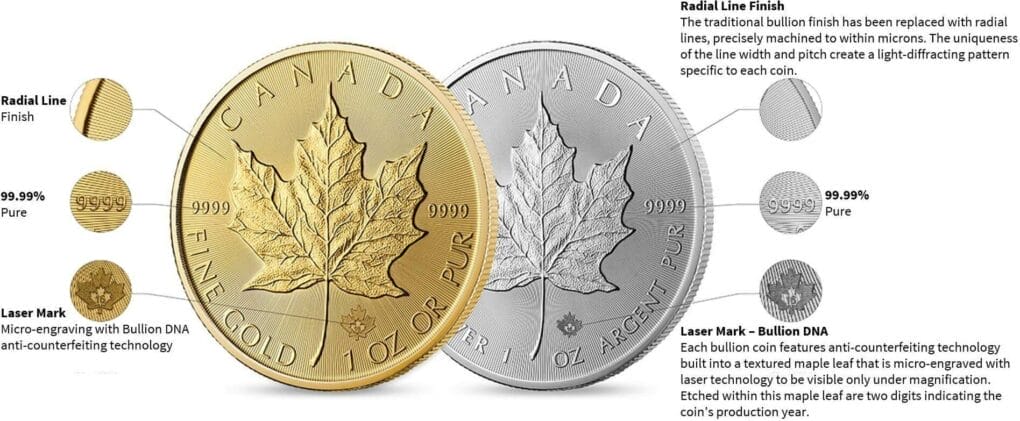

(December 7, 2023) - Important note from the author. "When someone puts a modern Maple Leaf coin on our counter, we are able to quickly able to determine if the maple leaf coin is real or counterfeit just by the fine radial lines and laser mark in the shape of a maple. It is our belief that we can only make this claim for this type of bullion, and no other mint has come close to protecting its end users as much as the Royal Canadian Mint has with this range of products".

In 2014, the Royal Canadian Mint introduced an innovative anti-counterfeiting security measure, initially embedded in the 1 ounce Canadian Maple Leaf gold coin.

Each die utilized in crafting the every maple leaf coin undergoes laser micro-engraving, embedding two distinct anti-counterfeiting security marks:

Subsequently, the Royal Canadian Mint captures a high-resolution digital image of the coin, preserving this data on their servers. These digitized, distinctive features are referred to by the mint as Bullion DNA.

Authorized Bullion DNA dealers and distributors now possess the capability to digitally authenticate each 1 oz gold bullion Maple Leaf coin produced from 2013 onwards. They are equipped to swiftly verify the legitimacy of each individual coin directly with the mint, a process that takes mere seconds.

This robust verification system offers a heightened level of confidence to those engaged in handling Maple Leaf coins, a previously unprecedented advancement in the precious metals industry.

Following the successful implementation of the laser engraved security feature, it was extended to the 1 ounce silver and 1 ounce platinum bullion Maple Leaf coins in 2014 and 2015, respectively.

In an era where the market is inundated with counterfeit goods, safeguarding yourself against fake gold and silver is crucial. This article delves into the nuances of detecting and protecting against counterfeit precious metals.

Understanding the gravity of counterfeit precious metals lays the groundwork for safeguarding oneself. Counterfeits often mimic the appearance but lack the intrinsic value of authentic gold and silver.

Detecting counterfeit gold and silver requires a discerning eye. Certain telltale signs, such as weight inconsistencies, improper markings, and suspiciously low prices, signal potential counterfeits.

Employing various testing methods, like specific gravity tests, acid tests, and magnetic tests, can help verify the authenticity of gold and silver.

Knowing how to protect oneself against counterfeit precious metals is paramount.

Purchasing gold and silver from reputable and certified dealers or authorized sellers minimizes the risk of buying counterfeit metals.

Conducting physical inspections, such as checking for proper markings, examining edges, and assessing the quality of the metal, assists in identifying counterfeits.

Utilizing the expertise of professional appraisers or laboratories can provide accurate assessments of precious metals' authenticity.

Proper storage of gold and silver ensures their preservation and reduces the risk of counterfeit infiltration.

Being vigilant and informed is the key to safeguarding oneself against counterfeit gold and silver. Employing a combination of knowledge, inspection, and reliable sources can protect against falling victim to counterfeit precious metals.

So you want to know why bullion dealers like 401Gold Inc and Troy.ca charge a higher fee for your gold or silver or other precious metals.

Essentially premium over spot indicates what the mark up is for a particular bullion product over what the current market price per ounce is for that particular metal type. For example, if Gold is trading at $2,000 per ounce on the market but the Gold coin you want is selling for $2020, then the premium is $20.

A typical example of how premiums are calculated as follows:

A mint buys gold at spot (the current rate on the markets for that metal). Lets assume that spot = $2000 for this exercise

That mint then turns that gold into a bullion product like a bar or a coin, and they add a fee for that service. This is normally around $50 for a one ounce gold bar

So not the item costs $2000 + $50 = $2050

Then the mint sells these gold products to a distributor, who has to store very large supplies of gold in very safe storage. For this the distributor adds a fee, and this can also be around $50

So now the item costs $2000 + $50 + $50 = $2100

And 401Gold and Troy.ca buy from the distributor, and we place a similar markup of around 450 to the final sale price

And the final price including all fees etc (the premium) = $2000 + $50 + $50 + $50 = $2150

Investing in precious metals like gold and silver involves grasping the concept of premiums, which significantly impact the overall cost and value of these assets. Let's delve deeper into understanding what these premiums entail and how they affect the precious metals market.

Precious metals have intrinsic value, but the price you pay over and above the spot price is referred to as the premium. This additional cost is influenced by various factors that discern the worth of these metals in the market.

Several elements contribute to the determination of premiums, including scarcity, demand-supply dynamics, economic stability, geopolitical factors, and market sentiment.

Gold and silver, despite both being precious metals, exhibit different premium patterns owing to their unique characteristics and industrial applications.

There are primarily two types of premiums: Bullion Premiums and Numismatic Premiums, each having distinct attributes that affect their pricing.

Bullion premiums typically relate to the cost above the spot price for newly minted coins or bars, influenced mainly by the purity and demand for these products.

Numismatic premiums involve the added cost for coins or bars due to their historical or collectible value, often varying based on rarity and historical significance.

The historical analysis of premiums unveils patterns and shifts influenced by economic conditions, investor behavior, and market cycles.

Fluctuating market conditions, such as inflation, interest rates, and global uncertainties, significantly impact premiums, causing fluctuations in their prices.

Understanding the calculation of premiums involves considering factors like the spot price, fabrication costs, dealer premiums, and additional charges.

The volatility in premiums can be attributed to changing investor sentiments, geopolitical tensions, sudden demand surges, or even production limitations.

Investors often strategize based on premium analysis, balancing the allure of high premiums with the potential risks and returns associated.

While high premiums may seem attractive, they also pose risks, such as reduced liquidity and higher costs, impacting the overall investment value.

Making informed decisions about purchasing precious metals involves evaluating premiums, dealer credibility, authenticity, and personal investment goals.

The premiums in the gold and silver markets play a vital role in stabilizing the market, reflecting investor confidence and economic indicators.

Premiums exhibit variations globally, influenced by regional economic conditions, cultural preferences, and governmental policies.

Forecasting the premiums involves analyzing market trends, geopolitical shifts, technological advancements, and evolving investor behaviors.

Understanding premiums for gold and silver is crucial for investors to make informed decisions, manage risks, and maximize potential returns in the precious metals market.

One of the most common question we get asked is "what is better. Gold bars or gold coins?".

And for us to answer that question fully, we always ask these questions to help us guide you n the right direction.

Gold coins like Gold Maple Leaf coins are minted with both the year they are minted, as well as a denomination (eg $50). So if someone wants to give a present to someone born in 1995, they may pay more for a coin with that date on it. There is also a possibility of your gold coin of choice having a much higher numismatic value due to a number of factors, and typically gold bars never attract this value.

But gold bars are accepted worldwide, so if you end up taking a gold maple leaf coin overseas, the gold bar might get you a higher payout

Here at 401Gold Inc and Troy.ca, we tend to recommend that Canadians stick to Gold Maple Leaf coins as they are always in demand

And if you plan to go overseas (non US) with your gold, then we recommend well known gold bars brands like the 1 oz Royal Canadian Mint Gold bar or any of the gold bars from Pamp Suisse

Or if you plan to take your gold to the United States, then you should seriously consider buying US gold coins as they will get a much higher payout in the US

Gold, a timeless asset, entices investors with its allure and stability. In the investment world, two primary forms stand out: gold bars and gold coins. Each holds its unique characteristics and appeals, catering to diverse investment objectives and preferences.

When delving into the world of precious metals, understanding the distinction between gold bars and gold coins is crucial. Both hold intrinsic value and serve as hedges against economic uncertainties. Gold bars, typically ranging in various sizes and weights, are usually favored by institutional investors and those seeking substantial investments due to their lower premium over the spot price of gold.

Gold bars come in different forms, including cast bars and minted bars. Cast bars, produced through a simpler method, are cost-effective but may lack the finesse of minted bars. Conversely, minted bars, stamped with authenticity marks and serial numbers, are highly preferred for their quality assurance. However, their premiums are relatively higher.

On the other hand, gold coins, often cherished by collectors and investors alike, present a blend of historical significance and investment potential. They come in various designs, sizes, and weights, appealing to a broader audience due to their aesthetic appeal and cultural significance.

When deciding between gold bars and gold coins, assessing liquidity, storage convenience, and market variations becomes imperative. Gold coins, with their divisibility and varied sizes, offer enhanced liquidity compared to larger gold bars. However, storage for a collection of coins might pose challenges compared to compactly stored bars.

Investors' decisions regarding gold bars or coins depend on multiple factors, including their financial goals, prevailing market conditions, and personal preferences. While bars might suit those aiming for substantial investments, coins could cater to individuals seeking flexibility and diversity in their portfolios.

Both gold bars and coins face risks, including counterfeiting concerns, market volatility, and challenges in resale. Verifying authenticity and staying updated on market trends are crucial to navigate these risks effectively.

The choice between gold bars and coins can also depend on the investment horizon. Long-term investors might favor bars for their cost-effectiveness, while short-term investors may prefer the flexibility offered by coins.

In recent times, ethical sourcing and sustainability have gained prominence in the investment landscape. Assessing mining practices, environmental impact, and ethical sourcing becomes pivotal for investors concerned about these aspects.

Financial advisors often recommend diversification strategies that might include both gold bars and coins, depending on an individual's investment objectives and risk appetite. Investor experiences and expert viewpoints offer valuable insights into crafting a balanced investment portfolio.

In the debate between gold bars and gold coins, there is no one-size-fits-all answer. Both possess distinct advantages and drawbacks, catering to different investment strategies, preferences, and goals. The choice ultimately hinges on an investor's specific circumstances, financial objectives, and risk tolerance.

This article will teach you how to get the most for your precious metals, and also give you the payouts offered by 401Gold Inc

To see our live payouts for coins see https://www.401gold.ca/payouts-coins/

And to see our live payouts for bars see https://www.401gold.ca/payouts-bars/

So you have made the decision to sell your precious metals, and you now need cash for your next move.

Option # 1 - try to sell it yourself on Facebook, Kijiji or Reddit, and get a much higher sale price closer to spot + premium

Option # 2 - find a precious metals dealer and try to get the highest payout possible, which will tend to be close to spot or a little less depending on the item.

Option # 3 - if you have a special high value item of bullion (or collectible), 401Gold Inc offers a consignment service where we hold and list your items for sale and we only charge you a fee on sale

For option # 1, there are two obvious problems for you and the buyer being that the prospective buyer has no idea if what you are selling is real (or not), and you have to meet these buyers at your home, business or in a car park which is a great security risk for you both.

Here at 401Gold, we make both options available to you.

Once you become a client of 401Gold, you may use our facilities free of charge. This means you can advertise your metals for sale, and meet your prospective buyers at our store where we will test your items and give you the space to close your deal without any costs to both yourself and your buyer.

So we give you a safe space to do your business, and further do all the necessary testing of your metals to prove that such metals are what you are offering. And we offer this to you “free of charge”.

We have many clients who use this service already, and the most common question we get asked is “why does 401Gold offer this service free of charge?”.

The answer is very simple. You will be bringing a precious metals buyer into our store, and we might get the chance to serve this person with precious metals sales in the future.

We see this program as a win/win for everyone, and it meets one of our key mandates. To create a community of precious metals investors, where we all work together and win together.

So you live in Canada, and you really like a certain gold coin that isn't pure gold (24 karat or 999 or 9999 or 99999).

This coin that you are really interested in could be an:

The following is a summary of the law that pertains to these types of coins

In Canada, precious metal bullion is typically free from GST/HST if they are in the form of bars, ingots, coins, or wafers made of gold, silver, or platinum. The purity must be at least 99.50% for gold and platinum and 99.9% for silver. However, products made of palladium do incur GST/HST.

For exact information refer to the Canadian governments website (go to clause 27) - https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/17-1/definition-financial-instrument.html

The following is the text from that page as of September 1, 2023

Definition of precious metal

ss 123(1)

27. A "precious metal" is a bar, ingot, coin or wafer of gold, platinum or silver that is refined to a purity level of at least

Policy statement

P-192, Supplies of Precious Metals

28. A precious metal in the form of a bar, ingot or wafer at the required purity levels must generally be recognized and accepted for trading on Canadian financial markets. Ordinarily, these will bear markings indicating their purity level. They will also have an identification mark of the issuing financial institution or refinery. With respect to coins, only those metals at the required purity levels that have been issued by a government authority and that may be used as currency will qualify.

29. Any supply of a precious metal (i.e., gold, platinum or silver) meeting the purity requirements, as set out in the definition of precious metal in subsection 123(1), is a supply of a financial service and generally exempt. Metals of this quality are normally investment-related and are usually bought and sold on international exchanges that establish world-wide precious metal prices.

30. The sale or purchase of a precious metal, in the course of a commercial activity, that does not comply with the defined requirements is not considered a supply of a financial instrument, but rather a supply of property. Generally, the sale of gold, platinum or silver in bar, ingot, coin or wafer form with a purity level of less than 99.5% for gold and platinum, and less than 99.9% for silver is taxable at 7% or 15%. The sale of gold, platinum or silver at the defined purity levels, but not in the form of a bar, ingot, coin or wafer (e.g., in granular form), is taxable at 7% or 15%.

The answer is "it depends".

American Gold Eagles sell for well above spot in the United States, and are always in very high demand. So if you plan on travelling stateside, then these may be the right fit for you.

Vintage and ancient gold coins like sovereigns go up in value at a higher rate than just spot. So if you have a keen eye for these types of coins, and understand their growth potential, then the GST/HST issue should be a lesser problem for you.

But if you are buying bullion in Canada, and you don't want to pay tax then we recommend that you select only pure gold coins like the Gold Maple Leaf, the US Buffalo, the Australian Kangaroo or the British Britannia gold coins. Anything that is 999 or better is tax free.

As a Jewellery buyer in Toronto, 401Gold buys any type of jewellery made with any precious metal including gold, silver or platinum with or without any diamonds or other precious or semi-precious gemstones. The most common forms of jewellery we buy include rings, necklaces, bracelets and earrings.

Come into our store for a free appraisal and discover the exact weight, karats and dollar value of your precious metals that are in your piece. We also have gem testing equipment, where we can identify your diamonds, precious and semi-precious gemstones completely free of charge.

And remember that our free appraisal is unconditional, and there is no requirement for you to have to sell anything to us

401Gold also uses several machines including XRF Spectrometers, that allow us to appraise each metal without damaging your precious items of jewellery. In simpler terms, WE DO NOT DO ACID OR SCRATCH TESTS!

If you have a lot of jewellery to appraise, please give us a quick call first to arrange a suitable time.

See our huge jewellery payouts

Our motto is "Trust through Transparency". This business principle guides us in every transaction, especially so when family members need to sell a loved ones jewellery in a difficult time.

Typically in the cash for gold industry, jewellery buyers offer a a low flat fee for estate jewellery lots knowing that you probably aren't thinking at your best.

Our appraisers at 401Gold will offer you an item by item appraisal in writing, which will clearly show you exactly how much each item is worth at the time of the appraisal.

And with this appraisal, you can compare us against other jewellery buyers or come back later at a time that suits you as we will never pressure you to sell during this very hard time for you and your family.

Premium Jewellery like Cartier or Tiffany & Co has a greater value than normal jewellery, as they are both higher in quality and have a greater demand on the second hand market.

We show our higher payouts for premium pieces on our payouts page, but this price will be affected by a number of factors including:

The bottom line is that you can expect to be paid a higher payout for any piece that comes from a premium jeweller, and only an appraisal by our jewellery buyers will let you know how much more you will receive.

We love broken jewellery. It really doesn't matter to us whether your piece is broken or not. Gold is Gold, Silver is Silver and Platinum is well, Platinum. The one thing we do not buy in this category is loose diamonds and gemstones. If your gemstone isn't mounted in a precious metal, we cant buy it.

401Gold will buy any ring made of any precious metal with any type of gemstones

There are so many types of rings that find their way into our lives, and these tend to be the most common item we tend to appraise for our clients.

Anniversary Bands, Antique Rings, simple bands, Birthstone Rings, Bridal Sets, Contemporary Rings, Engagement Rings, Estate Rings, Eternity Bands, Fancy Wedding Bands, Fashion Rings, Promise Rings, Solitaire Rings, Vintage Rings, Wedding Bands and 3-Stone Rings

Less common rings that we can also appraise include Claddagh Rings, Cluster Rings, Cocktail Rings, Flexible Rings, Gimmel Rings, Halo Rings, Nugget Rings, Posey Rings, Signet Rings, Spinner Rings, Stack Ring/s,

401Gold will buy any ring made of any precious metal with any type of gemstones

Necklaces made of precious metals come in all sorts of shapes and sizes, and our jewellery buyers can help you understand exactly what the value of your necklace is.Industry standard lengths for typical necklaces are:

Typical necklace styles include:

401Gold will buy any Bracelet made of any precious metal with any type of gemstones

Bracelets many times offer the highest payouts for jewellery, as the more than often have a significantly higher weight of precious metals by themselves. The different types of bracelets include:

401Gold will buy any earring/s made of any precious metal with any type of gemstones

Earrings most times have the smallest amount of precious metals of all the different types of jewellery, with the clasps many times not having a high karat count and may not even be a precious metal at all. The most popular types of earrings are:

Gold has always been a valuable commodity, but with the rise in counterfeit goods, it's important to know how to distinguish between real gold and fake gold. Whether you're buying jewelry or investing in gold bullion, being able to tell the difference can save you from being duped. Here's how you can tell if your gold is real or fake.

One of the first things to look for when identifying real gold is its color and luster. Real gold has a distinct, warm color and a shiny luster that is hard to replicate. Additionally, real gold is dense and heavy compared to other metals.

Fake gold is often made from a mixture of other metals, such as copper, zinc, or nickel, which can give it a different color and luster. It is also less dense and lighter than real gold, making it easier to distinguish by weight alone.

One simple way to test if your gold is real or fake gold is to use a magnet. Real gold is not magnetic, so if your gold is attracted to the magnet, it's likely fake.

Another common method to test gold is the scratch test. Real gold is very resistant to scratches, so if you can scratch the surface easily with a pin or a knife, it's likely fake.

The acid test is a more accurate way to test gold authenticity. By applying a small amount of nitric acid to the gold, you can determine if it's real based on the reaction. Real gold will not react to the acid, while fake gold will.

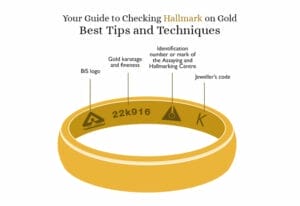

When purchasing gold jewelry, it often bears a hallmark stamp, which identifies its purity and the manufacturer. This stamp is one of the simplest and quickest ways to determine the gold's purity.

The purity of gold is measured in "karats" or "millesimal fineness." Millesimal fineness is a system used to denote the purity of platinum, gold, and silver alloys, represented by parts per thousand of pure metal in the alloy. For instance, an alloy containing 75% gold is labeled as "750."

In essence, the fineness of the metal item (such as a bar, coin, or jewelry) indicates the weight of the fine metal it contains, relative to the total weight, including alloying base metals and any impurities. For example, silver coins often contain copper to make them a durable alloy. Historically, silver coins were composed of 90% silver and 10% copper by mass.

The Millesimal Fineness System recognizes certain standard purity numbers, including 333, 375, 417, 500, 583.3, 585, 625, 750, 834, 899, 900, 916, 958, 986, 990, 995, 999, 999.9, 999.99, and 999.999.

On the other hand, karats indicate the purity of gold, with higher karats representing purer gold. Common karat values include 8k, 10k, 14k, 18k, 22k, and 24k. In some countries like Denmark and Greece, 8k is the minimum karat considered for gold purity.

Standard valid purity numbers under the karat system are 8k, 9k, 10k, 14k, 18k, 20k, 22k, and 24k. It's important to note that while hallmarking is a good indicator of gold purity, it's not foolproof, as anyone can engrave a hallmark. If the hallmark numbers don't match the standard values mentioned above, it could indicate fake gold.

Additionally, not all genuine old gold jewelry may bear a hallmark, as the original markings may have worn off over time. In such cases, it's advisable to have the gold checked by an authentic jeweler of gold dealer.

If you're still unsure about the authenticity of your gold, it's best to seek the expertise of a professional gold dealer like 401Gold.ca. Jewelers and gold dealers have the tools and knowledge to test gold accurately.

In conclusion, knowing how to tell real gold from fake gold is essential for anyone buying or selling gold. By understanding the physical characteristics of gold and using simple tests, you can ensure that you're getting the real deal.

Gold has long been a symbol of wealth and luxury. Its value transcends time and economic fluctuations, making it a valuable asset for many individuals. At 401Gold, we understand the significance of gold and offer you an opportunity to turn your unwanted gold items into substantial payouts.

Gold has intrinsic value due to its scarcity and unique properties. Unlike paper currency, which can be printed in limitless quantities, gold is a finite resource, making it a reliable store of value. Additionally, gold is highly resistant to corrosion, making it a durable and long-lasting material.

We buy gold and here are our payouts...

See our payouts for gold coins

See our payouts for gold bars

See our payouts for gold jewellery and scrap gold

Selling your gold to us (or we buy gold) is a simple and straightforward process. You can start by contacting us through our website or visiting our store. Our experienced appraisers will evaluate your gold items and provide you with a competitive offer based on the current market prices.

We buy a wide range of gold items, including jewelry, coins, bullion, and scrap gold. Whether you have broken jewelry, old coins, or unwanted gold items, we are interested in purchasing them from you.

We offer competitive prices for your gold items, ensuring that you receive a fair value for your assets. Our prices are based on the current market prices, guaranteeing that you get the best possible payout.

Our selling process is designed to be simple and secure. We provide a safe environment for you to sell your gold items, ensuring that your transactions are conducted with the utmost confidentiality and security.

At 401Gold, we buy gold and we prioritize customer satisfaction. Our team of dedicated professionals is committed to providing you with the best possible experience, from start to finish.

To start the selling process, simply contact us through our website or visit our store. Our friendly staff will guide you through the process and answer any questions you may have.

Once we receive your gold items, our appraisers will carefully evaluate them to determine their value. We use state-of-the-art equipment to ensure accurate assessments.

After the evaluation process is complete, we will provide you with a competitive offer for your gold items. If you accept our offer, you will receive your payment promptly.

Check out our Google Reviews, and see how much our customers love our service and payouts

We buy a wide range of gold items, including jewelry, coins, bullion, and scrap gold.

We use the current market prices to determine the value of your gold items. Our experienced appraisers carefully evaluate each item to provide you with a fair offer.

Yes, we offer competitive prices for your gold items, ensuring that you receive a fair value for your assets.

The selling process typically takes a few days, depending on the volume of items you are selling. We strive to process transactions as quickly as possible while ensuring accuracy and security.

Yes, we prioritize the security and confidentiality of our customers. Our selling process is designed to provide a safe and secure environment for all transactions. That's why we buy gold!

In conclusion, selling your gold items to [Your Company Name] is a smart and lucrative decision. With competitive prices, a simple and secure process, and exceptional customer service, we are your trusted partner in turning your unwanted gold items into cash. Contact us today to get started! And we buy gold.

The most important factor when buying a gold coin in Canada relates the purity of the gold coin. We've written a comprehensive article about the pitfalls of buying gold coins that are not pure in Canada (see Risks for Canadian buyers on buying non pure gold coins).

The simplest explanation for this is that every bullion dealer in Canada that sells any coin that is not made of pure gold is required by law to charge HST on top of the value of the coin being sold.

Common gold coins that fit into this category include:

And this is why many bullion dealers in Canada either refuse to buy these coins back from the public, or are forced to offer very low payouts as they tend to be either melted or shipped to other countries that do not tax these types of coins.

So as a Canadian, it is better of you only invest in 24 Karat gold

The Canadian Maple Leaf is a highly sought-after bullion coin, known for its high purity and beautiful design. It is produced by the Royal Canadian Mint and is available in various sizes, including the 1 gram mini-gram, 1/20, 1/10, 1/4, 1/2, and 1 ounce.

In Canada, the Canadian Maple Leaf coin stands out as the most traded and sought-after gold coin. This popularity is beneficial when you decide to sell your coin, as there is a high demand for them. As a result, you can expect to receive a much higher payout compared to other gold coins.

But not all Gold Maples are equal.

In 2014, the Royal Canadian Mint added significant anti counterfeiting technology to both sides of each coin, making it easy for anyone to easily identify it as a real Gold Maple Leaf coin without the need for lab testing like every other gold bullion product on planet earth. The most obvious improvement was the addition of the super fine radial lines, which counterfeiters have attempted to copy and have always failed.

Its why 401Gold highly recommends Gold Maple Leaf coins (post 2014) to all our clientele. Please see our live prices for Gold Maple Leaf coins

The American Eagle gold coin is one of the most popular bullion coins in the world. It is produced by the United States Mint and is available in various denominations, including 1/10, 1/4, 1/2, and 1 ounce.

If you are planning on taking your gold coin to the United States, then this is the gold coin for you. We do not recommend people buy Gold American Eagles, unless you plan to take them out of Canada

The South African Krugerrand was the first gold bullion coin to be produced and is still one of the most popular coins among investors. It is minted by the South African Mint and is available in 1/10, 1/4, 1/2, and 1 ounce sizes.

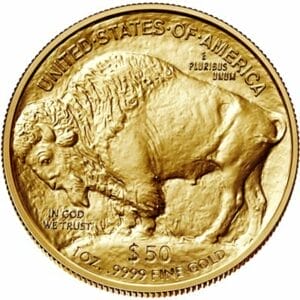

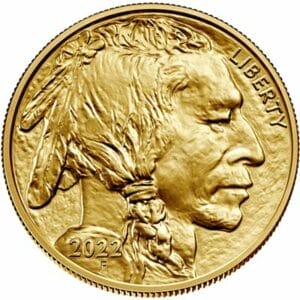

The American Gold Buffalo is a 24-karat gold bullion coin minted by the United States Mint, and is one of the best Gold coins to buy in Canada. It was first offered for sale by the mint in 2006. The coin is notable for its design, which features a depiction of a Native American chief on the obverse and an American bison (buffalo) on the reverse. The American Gold Buffalo is one of the purest gold coins ever minted by the United States, containing one troy ounce of 24-karat gold. It is a popular choice among investors and collectors alike.

The Chinese Panda is a unique bullion coin produced by the China Mint. What sets it apart is that the design of the coin changes annually, making each year's Panda coin a collector's item in addition to being an investment. As it is 24 Karat, it is surely one of the best Gold coins to buy in Canada.

The Australian Kangaroo, also known as the Gold Nugget, is produced by the Perth Mint in Australia. It features a unique kangaroo design on the reverse side and is available in various sizes, including 1/20, 1/10, 1/4, 1/2, 1, 2, 10, and 1 kilogram making it another best Gold coins to buy in Canada.

The Gold Britannia is a series of bullion coins minted by the Royal Mint in the United Kingdom. First introduced in 1987, the coin features a depiction of Britannia, the female personification of Britain, on the reverse side. The obverse side typically features the portrait of Queen Elizabeth II. The Gold Britannia is minted in various denominations, ranging from 1/10 oz to 1 oz, and is made of 24-karat gold, making it a popular choice among investors and collectors.

The Gold Philharmonic is a bullion coin produced by the Austrian Mint in Vienna, Austria. It was first minted in 1989 and quickly became one of the world's most popular bullion coins. The coin features the Great Organ of the Golden Hall in Vienna's Musikverein, as well as instruments from the Vienna Philharmonic Orchestra, on its obverse side. The reverse side of the coin depicts the famous pipe organ in the Musikverein concert hall. The Gold Philharmonic is minted in various denominations, including 1/25 oz, 1/10 oz, 1/4 oz, 1/2 oz, and 1 oz, and is made of 24-karat gold.

Gold coins have been used as currency and store of value for centuries, making them a symbol of wealth and prosperity. Their historical significance adds to their appeal, especially for collectors.

Gold has traditionally been seen as a hedge against inflation, as its value tends to increase during times of economic uncertainty. Investing in gold coins can help protect your wealth against the effects of inflation.

Including gold coins in your investment portfolio can help diversify your holdings and reduce overall risk. Gold often behaves differently from other assets, making it a valuable addition to a well-rounded portfolio.

The purity of gold coins is measured in karats, with 24 karats being the purest form. Most gold coins are either 22 or 24 karats, with higher purity coins typically commanding a higher price.

Gold coins come in various weights, ranging from fractions of an ounce to several ounces. The weight of the coin will affect its price, with heavier coins generally costing more.

The design of a gold coin can also affect its value, especially for collectors. Coins with unique or historically significant designs may be more valuable than standard bullion coins.

The premium is the additional cost you pay above the spot price of gold. It includes the cost of manufacturing, distribution, and dealer markup. When buying gold coins, it's important to consider the premium and its impact on the overall cost.

There are several types of gold coins available for investment, each with its own characteristics and appeal.

Bullion coins are minted primarily for investment purposes and are valued based on their gold content. They are typically issued by government mints and are widely recognized and traded.

Numismatic coins are valued not only for their gold content but also for their rarity and historical significance. They are often sought after by collectors and can command higher premiums.

Proof coins are specially minted coins with a high-quality finish and are often used as collector's items. They are not typically bought for their gold content alone but rather for their aesthetic appeal.

When buying gold coins, it's important to purchase them from reputable dealers to ensure their authenticity and quality.

Authorized dealers are dealers who have been approved by government mints to sell their coins. They are often a safe and reliable source for purchasing gold coins.

There are many online retailers that sell gold coins, making it convenient to purchase them from the comfort of your home. However, it's important to research the retailer's reputation before making a purchase.

Once you've purchased gold coins, it's important to store them properly to protect their value.

Some investors choose to store their gold coins at home, but this comes with risks such as theft or damage. If you decide to store gold coins at home, consider investing in a secure safe or vault.

Another option for storing gold coins is to rent a safe deposit box at a bank. This provides a secure and convenient way to store your coins, but it may come with additional costs.

Investing in gold coins can be a lucrative and rewarding venture, providing both financial security and the joy of collecting. By understanding the factors to consider when buying gold coins and knowing where to buy them, you can make informed decisions that will benefit your investment portfolio.

You can buy Silver Maple Leaf coins from 401Gold and Troy.ca, and you can see our live prices here - Buy Silver Maple Leaf coins

Investing in precious metals like silver is a smart financial move, and one of the best ways to invest in silver is to buy Silver Maple Leaf coins. These coins are highly sought after for their purity, quality, and beautiful design. In this article, we will discuss everything you need to know about buying Silver Maple Leaf coins in Toronto & Canada.

Silver Maple Leaf coins are produced by the Royal Canadian Mint and are one of the purest silver coins in the world, with a purity of 99.99%. They are legal tender in Canada and have a face value of 5 Canadian dollars. The coins feature the iconic maple leaf design on one side and the portrait of Queen Elizabeth II on the other.

The Canadian Silver Maple Leaf is an annual silver bullion coin issued by the Government of Canada since 1988 and produced by the Royal Canadian Mint. It holds a legal tender status with a face value of 5 Canadian dollars, while its market value fluctuates based on the silver spot price. With a silver content of 99.99%, it ranks among the finest official bullion coins globally, weighing 1 troy ounce (31.10 grams).

Featuring Queen Elizabeth II's profile on the obverse and the Canadian Maple Leaf on the reverse, the coin incorporated new security features in 2014, including radial lines and a micro-engraved laser mark.

Initially released with Elizabeth II's profile on the obverse, subsequent standard editions showcased three versions of the Queen's profile:

Coins issued to the public starting late 2023 now feature a new obverse depicting her successor, Charles III, and you can buy silver maple leaf coins with King Charles

The reverse of the Silver Maple Leaf coin features the iconic Canadian Maple Leaf design, which has remained unchanged since its introduction in 1988. In 2014, new security features, including radial lines and a micro-engraved laser mark, were added, affecting both the obverse and reverse designs.

The phrases "CANADA" and "FINE SILVER 1 OZ ARGENT PUR" are standard elements on the coin.

With a face value of 5 Canadian dollars, the Silver Maple Leaf holds legal tender status. Its market value, however, is determined by the current spot price of silver and typically exceeds its nominal face value. Weighing 1 troy ounce (31.10 grams), the coin boasts a silver content of 99.99%, placing it among the highest purity official bullion coins worldwide.

One common issue with Silver Maple Leaf coins is the presence of milk spots, which are blemishes with a milky-white appearance. These spots occur when cleaning detergent residue is not fully removed before the coin is heated in the annealing furnace. In response to this issue, the Royal Canadian Mint introduced "MINTSHIELD" surface protection technology in 2018 to prevent the formation of milk spots.

Initially, Silver Maple Leaf coins were packaged in Mylar, but since 2009, due to increased demand, they are packaged in semi-transparent tubes with a yellow lid featuring the RCM logo. Special editions may have tubes with lids in other colors, such as orange, red, blue, dark blue, or grey. Each tube contains 25 coins. Additionally, there are boxes available that contain 20 tubes each.

Special editions to buy Silver Maple Leaf coins can be categorized as follows:

In 1998, to celebrate the 10th anniversary of the Silver Maple Leaf series, a single-issue 10-ounce version was produced. Typically, Silver Maple Leaf coins are only minted in 1-ounce sizes, but for this special occasion, a reverse proof 10-ounce Silver Maple Leaf was struck. However, due to its high price ($200, with the silver spot price around $6 at the time) and lack of interest, the planned 30,000 10-ounce Silver Maple Leafs were not completely sold out, and more than half were melted down. The cases for these coins were recycled for the production of one of the 2004 2-ounce bimetallic coins issued by the RCM. This explains why some of the silver Certificate of Authenticity (COA) numbers exceed 14,000, even though only around 13,000 of the coins survived.

In 1999, many Silver Maple Leaf coins were issued with a privy mark to commemorate the 20th anniversary of the RCM Maple Leaf Program. The following year, the coins featured a privy mark with fireworks and the number 2000. Another version of the Silver Maple Leaf was issued to commemorate the millennium, with coins double-dated 1999 and 2000.

Some privy-marked Silver Maple Leaf versions were exclusively available in Europe. In 2005, the Royal Canadian Mint struck the Liberation of the Netherlands triple privy silver Maple Leaf, the rarest of all Silver Maple Leaf coins, for the Royal Dutch Mint. The first coin produced by the facility was graded SP70 on the Sheldon scale and was intended to be presented to Queen Beatrix of the Netherlands.

In 2005, The Royal Canadian Mint issued The North America LEGACY of LIBERTY pure silver commemorative coin set, which included two coins dated 2004 and two coins dated 2005. The set also included the first poppy colorized quarter (2005), a symbol of remembrance, hope, and sacrifice by the Royal Canadian Legion. Three 1-ounce pure silver maple leaf coins with privy marks were also made: Victory Europe Day - May 8, 1945 (2005), Victory Japan Day - September 2, 1945 (2005), and D-Day - June 6th, 1944 (2004), with only 4200 sets minted.

The RCM also minted a special edition coin series called the 'Maple Leaf Forever' series, featuring three maple leaf symbols on the reverse. The mint produced 100,000 of these designs in 1/2 ounce .9999 fine silver coins and 200 strikes of the same design in a large 60mm diameter .9999 fine gold coin. Many other Royal Canadian Mint coins feature maple leaf symbols, including the $20 for $20 series, the 'Piedfort Maple' series, the 5-ounce silver 25th-anniversary coins, 1-ounce silver 25th-anniversary coins with gold guild clad (an identical coin is minted in 1 ounce of .9995 fine platinum), and fractional 25th-anniversary coins in silver and gold. Additionally, there are the 1-kilogram $250 coins minted from 2011 to 2015 with mintage numbers of 999, 1200, 600, 600, and 500, respectively.

Another series noted by argent pur signa includes the SML edge lettering 20 coins, which includes:

In Toronto, finding a reputable and trustworthy bullion exchange is paramount for those looking to invest in precious metals. With numerous options available, it can be overwhelming to choose the right one. However, Toronto's best bullion exchange stands out from the rest due to its exceptional services, security measures, and customer satisfaction.

Prices to buy Gold Bars | Silver Bars | Gold Coins | Silver Maple Leaf coins | Silver Rounds

Payouts for Gold/Silver/Platinum Coins | Gold/Silver/Platinum Bars

Investing in bullion, such as gold and silver, has been a popular choice for investors looking to diversify their portfolios and hedge against economic uncertainty. Toronto's best bullion exchange offers a reliable platform for individuals to buy and sell precious metals with ease and confidence.

A bullion exchange is a marketplace where individuals can buy and sell precious metals, such as gold, silver, platinum, and palladium, at current market prices. These exchanges provide a secure and transparent platform for investors to trade in these commodities.

Toronto's bullion exchange stands out for several reasons. Firstly, it offers a wide range of products, including coins, bars, and rounds, allowing investors to choose the best option based on their preferences and budget. Secondly, the exchange has a reputation for offering competitive prices, ensuring that investors get the best value for their money.

Toronto's best bullion exchange offers a range of services to meet the needs of investors. These include buying and selling precious metals, storage facilities, and educational resources for those new to investing in bullion.

Security is a top priority at Toronto's best bullion exchange. The exchange employs state-of-the-art security measures to protect investors' assets, including 24/7 monitoring, insurance coverage, and secure storage facilities.

This bit is easy - check out our amazing Google reviews

Getting started with Toronto's best bullion exchange is easy. Simply visit their website, create an account, and start browsing their inventory. Once you find the products you're interested in, you can place an order and complete the transaction online.

Toronto's best bullion exchange offers competitive pricing, with prices based on current market rates. Additionally, the exchange has transparent fee structures, ensuring that investors know exactly what they're paying for.

We have Toronto most advanced gold testing lab right at our front door, with undercover parking right out front ensuring that you can get in and out of our store quickly.

Are you selling Gold? 401Gold is the biggest gold buyer in Toronto, which lets us process more gold than anyone else and pass those bigger payouts onto our customers. Here are our jewellery payouts, our bar payouts and our coin payouts

Are you buying gold? 401Gold has a huge selection of gold bars, gold coins, silver bullion, Royal Canadian Mint collectibles and so much more, which are all online or available at our store.

401Gold is located near the intersection of the 401 and 404 highways, and makes it a perfect location for anyone in the GTA to get to us quickly making us a perfect gold shop near me.

401Gold is strategically located in the heart of the city, making it easily accessible to all. Whether you're driving or taking public transportation, our convenient location ensures that you can visit us whenever you need to, without any hassle.

At 401Gold, we understand that everyone's taste is different, which is why we offer a wide range of gold products to suit every style and budget. From classic designs to modern pieces, our collection has something for everyone.

When you shop at 401Gold, you can rest assured that you're getting the highest quality gold products. Our expert craftsmen meticulously create each piece, ensuring that it meets our stringent quality standards. With 401Gold, you're not just buying gold; you're investing in a piece of art.

Don't just take our word for it; hear what our customers have to say about us (see our Google reviews) . Our satisfied customers have consistently praised us for our exceptional customer service, high-quality products, and unbeatable prices. At 401Gold, customer satisfaction is our top priority.

Buying from 401Gold is easy and convenient when looking for a gold shop near me. You can visit our store in person or shop online from the comfort of your home. We accept a variety of payment methods, including credit cards and online payment services, making it easy for you to pay for your purchase. Once your order is placed, we'll ship it to you promptly, ensuring that you receive your gold products in no time.

At 401Gold, we understand that buying gold can be daunting, especially for first-time buyers. That's why our expert staff are always on hand to provide you with guidance and advice to help you make informed decisions.

At 401Gold, customer service is our top priority. From the moment you step into our shop, you'll be greeted with a warm welcome and attentive service. We strive to make your gold shopping experience enjoyable and stress-free.

Is 401Gold Legit? Absolutely! 401Gold is a reputable and trusted gold shop with years of experience in the industry. We are committed to providing our customers with genuine gold products and exceptional customer service.

What Sets 401Gold Apart? 401Gold stands out from other gold shops due to our commitment to quality, craftsmanship, and customer satisfaction. We go above and beyond to ensure that our customers have a positive shopping experience with us.

Can I Sell Gold to 401Gold? Yes, you can! 401Gold buys gold from individuals looking to sell their gold items. Our experienced appraisers will evaluate your gold items and offer you a fair price based on current market rates.

In conclusion, 401Gold is your ultimate destination for all your gold needs. With our wide range of high-quality products, expert craftsmanship, and exceptional customer service, we are confident that you will find exactly what you're looking for at 401Gold. Visit us today and experience the 401Gold difference for yourself!

Introduction

Toronto's bustling metropolis is not only famous for its iconic skyline but also for its vibrant gold trading market. Among the numerous stores that buy and sell precious metals, 401Gold.ca stands out as Toronto's biggest gold buying store. This article dives into the world of gold trading in Toronto, highlighting the leading store that has earned the trust of countless customers over the years.

See our huge payouts for gold jewellery, our massive payouts for gold bars and our super high numismatic payouts values for gold coins.

Our plan is simple. Buy more than anyone else, by paying you more for your gold. This simple plan allows us to beat out our competitors, and give you the best result possible.

With the increasing interest in gold as a safe investment, gold buying stores have mushroomed across Toronto. However, not all stores are created equal. It's crucial to choose a reputable store that offers fair pricing and transparent services.

Our store has emerged as the premier destination for selling gold in Toronto, thanks to our unmatched services and customer satisfaction. Just check out our 401Gold Google reviews to see how good we are.

Gold Appraisal: We offer professional gold appraisal services to ensure you get the true value of your gold.

Instant Cash Offers: Our store provides instant cash offers, making it convenient for you to sell your gold without any delays.

Trust and Reliability: We've built a reputation for being trustworthy and reliable, ensuring that all transactions are conducted with the utmost integrity.

Competitive Pricing: Our pricing is competitive, ensuring that you receive the best value for your gold.

Testimonials: Our satisfied customers are our best ambassadors, and their testimonials speak volumes about our exceptional service.

Process of Selling Gold: We make selling gold easy and straightforward, ensuring a hassle-free experience for all our customers.

Expertise and Knowledge: Our team is knowledgeable about all aspects of gold trading, ensuring that you receive expert advice.

Customer-Centric Approach: We prioritize our customers' needs, ensuring that each transaction is tailored to their requirements.

Choosing Toronto's biggest gold buying store means opting for reliability, competitive pricing, and exceptional service. Our commitment to customer satisfaction and our expertise in the gold market make us Toronto's first choice for selling gold.

FAQs

You can buy Gold Maple Leaf coins from 401Gold and Troy.ca, and you can see our live prices here - Buy Gold Maple Leaf coins

Investing in precious metals like gold has been a cornerstone of secure investment portfolios for centuries. However, the rise in counterfeit coins has posed a significant threat to investors. The Royal Canadian Mint's Gold Maple Leaf (GML) coins are among the most sought-after gold coins worldwide, thanks to their high purity and renowned design. Yet, they are not immune to counterfeiting attempts, making counterfeit protection a critical concern for both investors and the Mint.

And this is why you should always buy Gold Maple Leaf coins

You should buy Gold Maple Leaf coins as they are a symbol of quality and security in the precious metals market. Introduced in 1979 by the Royal Canadian Mint, it has set a standard for gold coins globally with its 99.99% gold purity. Its design, featuring the iconic maple leaf and the effigy of Queen Elizabeth II, is recognized worldwide.

As the popularity of GML coins has grown, so has the sophistication of counterfeiters. Fake gold coins not only undermine investor confidence but also impact the integrity of the precious metals market. The Royal Canadian Mint has continuously innovated to outpace counterfeiters and protect investors.

Over the years, the Mint has introduced several cutting-edge security features to safeguard the authenticity of GML coins. These features are designed to be easily recognizable to investors while being extremely difficult for counterfeiters to replicate.

This is the number #1 reason why you should buy Gold Maple Leaf coins

The security features of GML coins have evolved significantly, reflecting advancements in technology and the Mint's commitment to security.

Micro-engraving involves adding intricate, minute details to the coin's design that are almost impossible to replicate accurately by counterfeiters. This feature is visible under magnification and provides a clear indication of authenticity.

Laser mark security includes the use of laser technology to create a small, textured maple leaf mark on the coin. This mark contains the coin's year of issue and is only visible under magnification, adding an additional layer of security.

Perhaps the most innovative security feature is the Bullion DNA technology. Each GML coin is engraved with a unique digital signature, allowing verified dealers to authenticate the coin using specialized equipment provided by the Royal Canadian Mint.

Verifying the authenticity of a Gold Maple Leaf coin involves several steps, including visual inspection, seeking reputable dealers, and utilizing technology. But the truth today as we type this ibn early 2024 is that this gold coin is the one and only gold coin that you can visually inspect and know with almost certain confidence that it is indeed real, which is why we always recommend - buy Gold Maple Leaf coins

Investors can look for the coin's security features, such as micro-engraving and the laser mark, as initial steps in authentication.

Annually issued by the Canadian government, the Canadian Gold Maple Leaf (GML) is a premier gold bullion coin crafted by the Royal Canadian Mint. This coin, recognized as legal tender, carries a nominal value of 50 Canadian dollars, though its market value fluctuates with the current gold prices. Renowned for its purity, the Gold Maple Leaf boasts a .9999 millesimal fineness, or 24 karats, with some editions even reaching .99999, making it one of the world's purest official bullion coins. Available in a standard weight of at least 1 troy ounce (31.10 grams), the coin also comes in various sizes and denominations, ranging from 1 gram to 1⁄2 ounce, valued between 50 cents and 20 Canadian dollars.

At this point, you must start realizing that you should only buy Gold Maple Leaf coins

The coin features the image of Queen Elizabeth II of Canada on the obverse, and the iconic Canadian Maple Leaf on the reverse. In efforts to enhance security, the Royal Canadian Mint introduced new features in 2013 and 2015. A laser-micro-engraved textured maple leaf, containing the year of issue visible only under magnification, was added to the reverse in 2013. In 2015, radial lines were incorporated into the background on both sides of the coin for added security.

A special edition of the Gold Maple Leaf, known as the Big Maple Leaf with a face value of $1 million and a metal value exceeding $3.5 million, was unveiled on May 3, 2007. This colossal coin, measuring 50 cm in diameter and 3 cm in thickness, weighs 100 kg and boasts an unmatched purity of 99.999%. However, one of the six coins minted was stolen from the Berlin Bode Museum on March 26, 2017, and is presumed to have been melted down, remaining unfound as of 2021.

The Gold Maple Leaf coin was first introduced in 1979, entering a market that had few competitors, such as the South African Krugerrand, which faced limited availability due to an economic boycott of apartheid-era South Africa, and the Austrian 100 Corona. Coins minted from 1979 to 1982 were produced with a fineness of .999.

Its time to buy Gold Maple Leaf coins

| Years | Weights ozt | Purity | Obverse |

| 1979–1982 | 1 oz. | 0.999 |

39-year-old Queen Elizabeth II

|

| November 1982 – 1985 | 1 oz., 1⁄4 oz., 1⁄10 oz. | 0.9999 | |

| 1986–1989 | 1 oz., 1⁄2 oz., 1⁄4 oz., 1⁄10 oz. | 0.9999 | |

| 1990–1992 | 1 oz., 1⁄2 oz., 1⁄4 oz., 1⁄10 oz. | 0.9999 |

64-year-old Queen Elizabeth II

|

| 1993 | 1 oz., 1⁄2 oz., 1⁄4 oz., 1⁄10 oz., 1⁄20 oz. | 0.9999 | |

| 1994 | 1 oz., 1⁄2 oz., 1⁄4 oz., 1⁄10 oz., 1⁄15 oz., 1⁄20 oz. | 0.9999 | |

| 1995–2004 | 1 oz., 1⁄2 oz., 1⁄4 oz., 1⁄10 oz., 1⁄20 oz. | 0.9999 | |

| 2005–2013 | 1 oz., 1⁄2 oz., 1⁄4 oz., 1⁄10 oz., 1⁄20 oz. | 0.9999 |

79-year-old Queen Elizabeth II

|

| 2014–2023 | 1 oz., 1⁄2 oz., 1⁄4 oz., 1⁄10 oz., 1⁄20 oz., 1 gram. | 0.9999 | |

| 2023-Present | King Charles III |

Purchasing gold Maple Leaf coins from licensed bullion dealers in Toronto or anywhere in Canada is crucial for several reasons, which revolve around ensuring the authenticity, quality, and legality of the transaction. Here are the key reasons why it's recommended to only buy these coins from licensed dealers:

In summary, purchasing Gold Maple Leaf coins from licensed bullion dealers in Toronto or Canada ensures that you are engaging in a safe, legal, and secure transaction, receiving authentic and high-quality products, and benefiting from expert advice and fair pricing. This minimizes the risks associated with investing in precious metals and enhances the overall investment experience.

If you're looking to sell silver Maple Leaf Coins, or any other silver coins, then 401Gold.ca and Troy.ca have you back, as we are the only bullion and precious metals dealer in Canada that publishes out coin payouts

The Silver Maple Leaf, an annual release by the Canadian Government since its inception in 1988 by the Royal Canadian Mint, has seen three standard and multiple special editions over the years.

Initially, the coin featured the profile of Elizabeth II on its obverse, with this design evolving through three distinct versions:

Starting in late 2023, Canadian coins, including the Silver Maple Leaf, introduced a new obverse featuring Charles III, marking a significant transition in the coin's design history.

The reverse side of the Silver Maple Leaf showcases the iconic Canadian Maple Leaf, a design that has remained consistent since the coin's introduction.

In 2014, to enhance security, the Royal Canadian Mint added radial lines and a micro-engraved laser mark, affecting both the coin's obverse and reverse designs.

This added security made all the post 2014 Silver Maple Leaf coins impervious to counterfeiting, and has made these bullion products the best in class in the world that are unmatched by any other bullion product. It is why 401Gold and Troy.ca pays a higher amount when you wish to sell Silver Maple Leaf coins made from 2014 or later.

These grading terms provide a standardized way to communicate the condition of silver coins within the numismatic community, helping collectors and investors evaluate the quality and value of their coins.

It's important to note that numismatic values can fluctuate based on market trends and collector preferences. Additionally, individual coins may have unique factors that contribute to their specific numismatic appeal. Collectors and investors interested in numismatic values should stay informed about market trends and seek the guidance of experts in the field.

Since its debut in 1988 by the Royal Canadian Mint, the Canadian Silver Maple Leaf has been an annual silver bullion coin release by the Government of Canada. This coin is recognized as legal tender with a nominal value of 5 Canadian dollars, though its market value fluctuates with the silver spot price. Boasting a 99.99% silver purity, it ranks as one of the highest quality official bullion coins available globally. Each standard coin weighs 1 troy ounce (31.10 grams).

The inscriptions "CANADA" and "FINE SILVER 1 OZ ARGENT PUR" are consistently featured on the Silver Maple Leaf, which is assigned a legal tender value of 5 Canadian dollars. Its market value, primarily influenced by the current silver spot price, typically surpasses its face value. Similar to other international bullion coins, the Silver Maple Leaf predominantly weighs 1 troy ounce (31.10 grams) and boasts a silver purity of 99.99%, placing it among the most prestigious official bullion coins globally.

A common issue with the Silver Maple Leaf is the presence of milk spots—a milky-white blemish—resulting from residual cleaning detergents not fully removed before the annealing process. In 2018, the Royal Canadian Mint (RCM) implemented "MINTSHIELD" surface protection to mitigate this problem.

Initially, Silver Maple Leaf's were packaged in Mylar. However, since 2009, due to heightened demand, they are now distributed in semi-transparent tubes with a yellow lid featuring the RCM logo, while special editions may come in tubes with orange, red, blue, dark blue, or grey lids, each containing 25 coins. Additionally, boxes holding 20 tubes are available for those looking for larger quantities.

This article categorizes special editions of the Silver Maple Leaf into several distinct groups, which may increase your payouts when you want to sell Silver Maple Leaf coins

To celebrate the Silver Maple Leaf series' 10th anniversary in 1998, a unique 10-ounce version was minted, diverging from the standard 1oz coin production. This commemorative 10oz coin, offered in reverse proof, did not achieve its sales target of 30,000 units due to its high price and limited interest, leading to more than half being melted down. The unsold units' cases were repurposed for a 2004 2oz bimetallic coin by the RCM, explaining why some silver COAs are numbered above 14,000, despite only approximately 13,000 coins surviving.

In 1999, the 20th anniversary of the RCM Maple Leaf Program was marked by issuing Silver Maple Leaf coins with a privy mark. The following year, coins featured a 2000 privy mark with fireworks, including a special millennium edition double-dated 1999 and 2000.

The 2005 Silver Maple Leaf featured a triple privy mark commemorating the Netherlands' Liberation, becoming the rarest coin in the series, minted for the Royal Dutch Mint. The first coin, graded SP70, was presented to Queen Beatrix of the Netherlands.

The RCM also released The North America LEGACY of LIBERTY silver coin set in 2005, including coins from 2004 and 2005, the first poppy colourized quarter, and three 1oz Silver Maple Leaf coins with privy marks commemorating significant World War II events.

The 'Maple Leaf Forever' series features three maple leaf symbols on the reverse, with 100,000 1/2 oz .9999 fine silver coins and 200 large diameter .9999 fine gold coins minted. Various other RCM coins incorporate maple leaf symbols, highlighting the emblem's significance across different collections.

Additionally, the Silver Maple Leaf edge lettering series includes themed sets such as the 2013 Bald Eagle, 2014 Bison Bull, 2014 White-Tailed Deer, 2015 Sportfish of North America, 2015-2016 Great Grizzly Bear, and 2014 $20 The Seven Sacred Teachings, each with limited mintages and unique designs celebrating aspects of North American wildlife and cultural teachings.

Sell Silver Maple Leaf coins or sell:

In all reality, we will buy any silver coin you want to sell